Australia’s original ethical fund is now an award winning, industry leader.

As a not-for profit, the better we are at investing, the more good we can do. It’s a powerful formula.

Our success is tried and tested. We’ve been ethical only investors since 1985.

We were driven by a mission to give back – to our investors, to the environment, to communities and to future generations.

Our formula is simple yet powerful: the better we are at investing, the more good we can do – because the profit we generate supports community initiatives and projects.

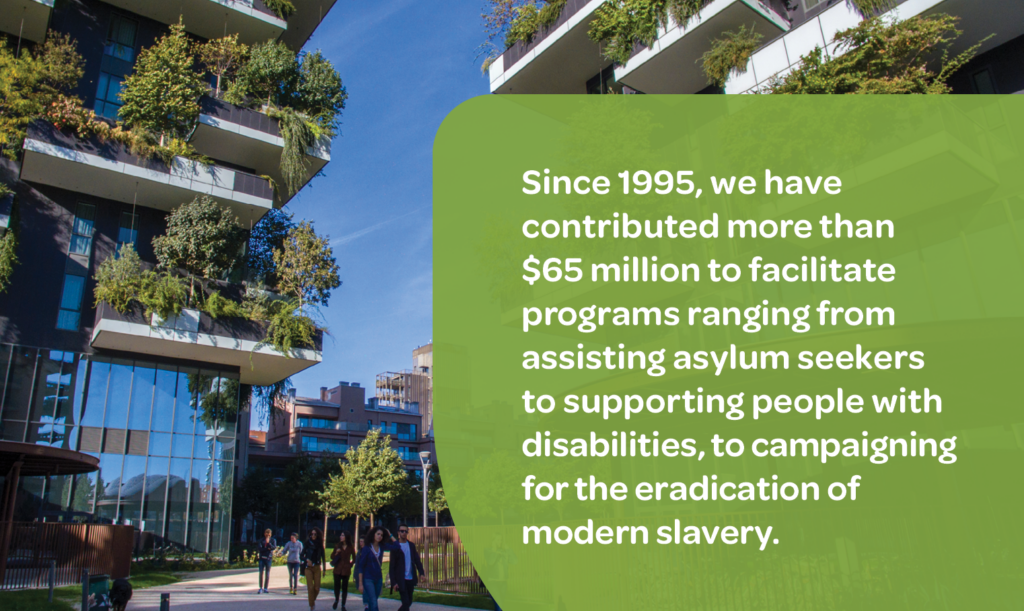

Fast forward to today, and U Ethical has grown into an award-winning ethical investing powerhouse. Serving over 3,000 clients, with $1.4bn in funds under management, we’ve contributed $68 million since 1995 to support people and planet, proving that our mission is more than just words—it’s a reality.

A not-for-profit driven to perform.

At U Ethical, we understand that financial markets are inherently cyclical, but believe it is the underlying financial fundamentals that drive long-term asset class performance. While short-term inefficiencies are common in equity markets, our disciplined, long-term investment approach allows us to turn these inefficiencies into opportunities.

Ethical investing is what we do. We are committed to delivering competitive returns without compromising our values. By excluding companies that fail to meet our ethical criteria and integrating environmental, social, and governance (ESG) factors into our investment decisions, we aim to reduce risks and position our portfolios to outperform conventional benchmarks.

Stewardship is central to our responsible investment strategy. Through active advocacy, engagement, and divestment, we take principled stances on key ethical issues and hold companies accountable for their actions.

Our ethical investment philosophy has remained steadfast over the years. We take pride in having delivered strong long-term financial results for our client while staying true to our commitment to ethical investing.

in funds under management—and growing.

in community contributions since 1995.

More than 3,000 client accounts including financial advisers, institutions and charities, community organisations and individual investors.

U Ethical believes that diversity, equity and inclusion are fundamental to creating a better business and core to creating better business outcomes. This is reflected in our hiring practices whereby we strive to employ a diverse team with a variety of attributes, experiences, perspectives, ideas and skills.

As an inclusive organisation, we welcome diversity across cultural identity, race, ethnicity, religious beliefs, age, gender, gender identity, sexual orientation, family/relationship status, disability, neurodiversity, education, learning styles, personality type and socio-economic background. We endeavour to maintain a workplace in which all individuals feel safe, respected, engaged and valued; where they experience a sense of belonging; and where they are empowered to contribute fully to U Ethical’s success.

Our team is supported by a board of up to nine non-executive directors and one executive director. Our diversity, equity and inclusion policy sets targets for gender diversity of 40% female, 40% male and 20% flexible. Our board, management team and overall organisation meet these targets.

At U Ethical, we are focused on serving the needs of all kinds of investors – from corporate and institutional, to not-for profits, to individual clients. Whether big or small, our clients trust us to deliver competitive returns while doing the right thing by communities and the planet.

We aim to live out our values of authenticity, progress and impact in the way we work and contribute to our community as well as for our clients. We take bold positions on important issues, and we advocate for those in need.

At U Ethical, we believe reconciliation between Aboriginal and Torres Strait Islander peoples and non-indigenous people’s is an important ethical issue for all Australians. As a leading ethical investor, we are determined to take meaningful action to advance reconciliation through our development of, and commitment to, our Reconciliation Action Plan.

At U Ethical, we are committed to our values of authenticity, progress and impact. We believe that these values align closely with a commitment to reconciliation—one where we make progress through authentic conversations, listening and learning and making change. We believe in our ability to make an impact on the communities in which we work and play. We are developing a RAP to ensure that reconciliation is embedded in our growth and impact on our community.

Through the process of implementing our Reflect RAP, we hope to learn and understand how we can be more thoughtful investors, and how we can drive better outcomes for Aboriginal and Torres Strait Islander peoples and communities. Importantly, our team members are also passionate about reconciliation. We began the process of reflection and learning by pursuing a number of internal initiatives to gauge interest and to learn more. Guided by our values, our team wishes to see real world impact from our reconciliation initiatives.

We are an autonomous social enterprise of the Uniting Church with an independent board. The board of directors sets a high standard for the governance of U Ethical. The structure, composition and diversity of the board are essential to its effectiveness.

U Ethical’s constitution provides for a board comprising between six and nine directors, including a non-executive chair and an executive director. Its governance structure includes three board committees – audit, risk and compliance; investment; and people and nominations – each of which operates under a charter.

U Ethical also engages an ethical advisory panel, including independent experts on environmental and social justice issues. The panel provides input on ethical considerations as well as contributing to thought leadership.

U Ethical is an Australian Financial Services Licence holder regulated by the Australian Securities and Investments Commission.

U Ethical believes that diversity, equity and inclusion are fundamental to creating a better business and core to creating better business outcomes. This is reflected in our hiring practices whereby we strive to employ a diverse team with a variety of attributes, experiences, perspectives, ideas and skills.

As an inclusive organisation, we welcome diversity across cultural identity, race, ethnicity, religious beliefs, age, gender, gender identity, sexual orientation, family/relationship status, disability, neurodiversity, education, learning styles, personality type and socio-economic

background. We endeavour to maintain a workplace in which all individuals feel safe, respected, engaged and valued; where they experience a sense of belonging; and where they are empowered to contribute fully to U Ethical’s success.

Our team of 24 is supported by a board of eight non-executive directors and one executive director. Our diversity, equity and inclusion policy sets targets for gender diversity of 50% female, 50% male and 20% flexible. Our board, management team and overall organisation meet these targets, with 50% female or more.* While we do not currently employ any Aboriginal and/or Torres Strait Islander team members, we continue to engage with Australian universities seeking opportunities to meet Aboriginal and Torres Strait Islander graduates or interns that are interested in working in the responsible investment industry.

At U Ethical, we are focused on serving the needs of all kinds of investors – from corporate and institutional, to not-for profits, to individual clients. Whether big or small, our clients trust us to deliver competitive returns while doing the right thing by communities and the planet.

We aim to live out our values of authenticity, progress and impact in the way we work and contribute to our community as well as for our clients. We take bold positions on important issues, and we advocate for those in need.

At U Ethical, we believe reconciliation between Aboriginal and Torres Strait Islander peoples and non-indigenous people’s is an important ethical issue for all Australians. As a leading ethical investor, we are determined to take meaningful action to advance reconciliation through our development of, and commitment to, our Reconciliation Action Plan.

At U Ethical, we are committed to our values of authenticity, progress and impact. We believe that these values align closely with a commitment to reconciliation—one where we make progress through authentic conversations, listening and learning and making change. We believe in our ability to make an impact on the communities in which we work and play. We are developing a RAP to ensure that reconciliation is embedded in our growth and impact on our community.

Through the process of implementing our Reflect RAP, we hope to learn and understand how we can be more thoughtful investors, and how we can drive better outcomes for Aboriginal and Torres Strait Islander peoples and communities. Importantly, our team members are also passionate about reconciliation. We began the process of reflection and learning by pursuing a number of internal initiatives to gauge interest and to learn more. Guided by our values, our team wishes to see real world impact from our reconciliation initiatives.

We are an autonomous social enterprise of the Uniting Church with an independent board. The board of directors sets a high standard for the governance of U Ethical. The structure, composition and diversity of the board are essential to its effectiveness.

U Ethical’s constitution provides for a board comprising between six and nine directors, including a non-executive chair and an executive director. Its governance structure includes three board committees – audit, risk and compliance; investment; and people and nominations – each of which operates under a charter.

U Ethical also engages an ethical advisory panel, including independent experts on environmental and social justice issues. The panel provides input on ethical considerations as well as contributing to thought leadership.

U Ethical is an Australian Financial Services Licence holder regulated by the Australian Securities and Investments Commission.

Although investors hold diverse viewpoints, they are unified through a strong commitment to social and environmental justice.

The Uniting Church’s engagement with the broader community, including through its community services agencies, is deep and wide. With a particular commitment to vulnerable individuals and communities, it helps thousands of Australians every day. U Ethical’s annual community contribution, financed from our operating surplus, takes advantage of the deep and wide reach of the Uniting Church, supporting its community initiatives and projects.

Our investment returns and community contributions indirectly help fund a diverse range of impactful initiatives including, mental health support, meals, social justice advocacy, and programs addressing domestic violence among others.

U Ethical Australian Equities Trust (Wholesale), U Ethical Australian Equities Trust (Institutional), U Ethical Australian Equities Trust (Retail), U Ethical International Equities Trust (Wholesale) and the U Ethical Growth Portfolio has been certified and classified by the Responsible Investment Association Australasia according to the operational and disclosure practices required under the Responsible Investment Certification Program. See www.responsiblereturns.com.au and RIAA’s Financial Services Guide for details.

RIAA’s Certification Symbol signifies that U Ethical offers responsible investment products; has undertaken continuing professional development on responsible investment; and conducts inquiries regarding client concerns about environmental social, governance or ethical issues. The Symbol also signifies that U Ethical has adopted the operational and disclosure practices required under the Responsible Investment Certification Program for the category of Investment Management Service. U Ethical is assessed against Responsible Investment Standard and Assessment Note- Sustainability Classifications. The classification signifies the degree to which sustainability is a consideration and binding investment criteria. There may be material differences between the definition and methodology of RIAA’s classification system and the way the terms ‘Responsible’/’Sustainable’/’Sustainable Plus’ are used by the product. Detailed information about RIAA, the Symbol and U Ethical can be found at www.responsiblereturns.com.au and in RIAA’s Financial Services Guide, together with details about other responsible investment products and services certified by RIAA.1

Because of this, you should consider your own objectives, financial situation and if the advice relates to the acquisition, or possible acquisition, of a particular financial product. Certifications are current for 24 months and subject to change at any time.

The Zenith Investment Partners (ABN 27 103 132 672, AFS Licence 226872) (“Zenith”) rating (assigned 27th June 2024) referred to in this piece is limited to “General Advice” (s766B Corporations Act 2001) for Wholesale clients only. This advice has been prepared without taking into account the objectives, financial situation or needs of any individual, including target markets of financial products, where applicable, and is subject to change at any time without prior notice. It is not a specific recommendation to purchase, sell or hold the relevant product(s). Investors should seek independent financial advice before making an investment decision and should consider the appropriateness of this advice in light of their own objectives, financial situation and needs. Investors should obtain a copy of, and consider the PDS or offer document before making any decision and refer to the full Zenith Product Assessment available on the Zenith website. Past performance is not an indication of future performance. Zenith usually charges the product issuer, fund manager or related party to conduct Product Assessments. Full details regarding Zenith’s methodology, ratings definitions and regulatory compliance are available on our Product Assessments and at Fund Research Regulatory Guidelines.

U Ethical Australian Equities Tr – Institutional received a Morningstar Medalist RatingTM of Silver as of 30/11/2024 © 2024 Morningstar, Inc. All rights reserved. Neither Morningstar, its affiliates, nor the content providers guarantee the data or content contained herein to be accurate, complete or timely nor will they have any liability for its use or distribution. This report or data has been prepared for clients of Morningstar Australasia Pty Ltd (ABN: 95 090 665 544, AFSL: 240892) and/or New Zealand wholesale clients of Morningstar Research Ltd, subsidiaries of Morningstar, Inc. Any general advice has been provided without reference to your financial objectives, situation or needs. For more information refer to our Financial Services Guide at www.morningstar.com.au/s/ fsg.pdf. You should consider the advice in light of these matters and if applicable, the relevant Product Disclosure Statement before making any decision to invest. Morningstar’s publications, ratings and products should be viewed as an additional investment resource, not as your sole source of information. Morningstar’s full research reports are the source of any Morningstar Ratings and are available from Morningstar or your adviser. Past performance does not necessarily indicate a financial product’s future performance. To obtain advice tailored to your situation, contact a financial adviser

U Ethical Australian Equities Tr – Wholesale received a Morningstar Medalist RatingTM of Silver as of 30/11/2024

© 2024 Morningstar, Inc. All rights reserved. Neither Morningstar, its affiliates, nor the content providers guarantee the data or content contained herein to be accurate, complete or timely nor will they have any liability for its use or distribution. This report or data has been prepared for clients of Morningstar Australasia Pty Ltd (ABN: 95 090 665 544, AFSL: 240892) and/or New Zealand wholesale clients of Morningstar Research Ltd, subsidiaries of Morningstar, Inc. Any general advice has been provided without reference to your financial objectives, situation or needs. For more information refer to our Financial Services Guide at www.morningstar.com.au/s/ fsg.pdf. You should consider the advice in light of these matters and if applicable, the relevant Product Disclosure Statement before making any decision to invest. Morningstar’s publications, ratings and products should be viewed as an additional investment resource, not as your sole source of information. Morningstar’s full research reports are the source of any Morningstar Ratings and are available from Morningstar or your adviser. Past performance does not necessarily indicate a financial product’s future performance. To obtain advice tailored to your situation, contact a financial adviser

Certain information contained herein (the “Information”) is sourced from/copyright of MSCI Inc., MSCI ESG Research LLC, or their affiliates (“MSCI”), or information providers (together the “MSCI Parties”) and may have been used to calculate scores, signals, or other indicators. The Information is for internal use only and may not be reproduced or disseminated in whole or part without prior written permission. The Information may not be used for, nor does it constitute, an offer to buy or sell, or a promotion or recommendation of, any security, financial instrument or product, trading strategy, or index, nor should it be taken as an indication or guarantee of any future performance. Some funds may be based on or linked to MSCI indexes, and MSCI may be compensated based on the fund’s assets under management or other measures. MSCI has established an information barrier between index research and certain Information. None of the Information in and of itself can be used to determine which securities to buy or sell or when to buy or sell them. The Information is provided “as is” and the user assumes the entire risk of any use it may make or permit to be made of the Information. No MSCI Party warrants or guarantees the originality, accuracy and/or completeness of the Information and each expressly disclaims all express or implied warranties. No MSCI Party shall have any liability for any errors or omissions in connection with any Information herein, or any liability for any direct, indirect, special, punitive, consequential or any other damages (including lost profits) even if notified of the possibility of such damages.

We are certified as a B Corporation and have been since 2018. B Corporations are businesses that meet the highest standards of social and environmental performance, public transparency, and legal accountability to balance profit and purpose.

In our most recent B Impact assessment, U Ethical Investors earned an overall score of 131.0. To become certified, a company must score at least 80 points across five areas; governance, workers, community, environment and customers. The median score for ordinary businesses who complete the assessment is currently 50.9. A full breakdown of our B Impact Score is available here.

We participate as a socially responsible investor through membership of industry bodies including:

The information provided is general information only. Before acquiring a U Ethical product, you should read the disclosure document(s) for the product and seek independent advice to ensure it is appropriate for your particular objectives, financial situation and needs.

The disclosure documents are available from this website and contain details of the issuer of each product. U Ethical is a registered business name of Uniting Ethical Investors Limited ABN 46 102 469 821 AFSL 294147.

We acknowledge Aboriginal and Torres Strait Islander peoples as the traditional owners and original custodians of the lands and waters on which we all live and work. We pay our respects to Elders past and present.

©2025 Uniting Ethical Investors Limited